The Canadian government offers various incentive programs to help the First time Home Buyers make their dream of homeownership a reality. Here’s an overview of some of the most popular programs.

Federal Programs

First Time savings account (FHSA)

The Canada First Time savings account is a new registered plan that allows prospective first-time home buyers to save for their first home tax-free (up to certain limits). You will be able to open an FHSA starting April 1, 2023.

- The program will be open to all Canadians who are first-time homebuyers and at least 18 years old2.

- Money contributed to an FHSA is tax-deductible, similar to RRSP contributions.

- Contributions will be limited to $8,000 per year with a lifetime limit of $40,000.

- You can make tax-free withdrawals at the time of purchase of your first home from this account

At the time of this blog, only Questrade is opening the FTSA. Head over to their website to open your account..

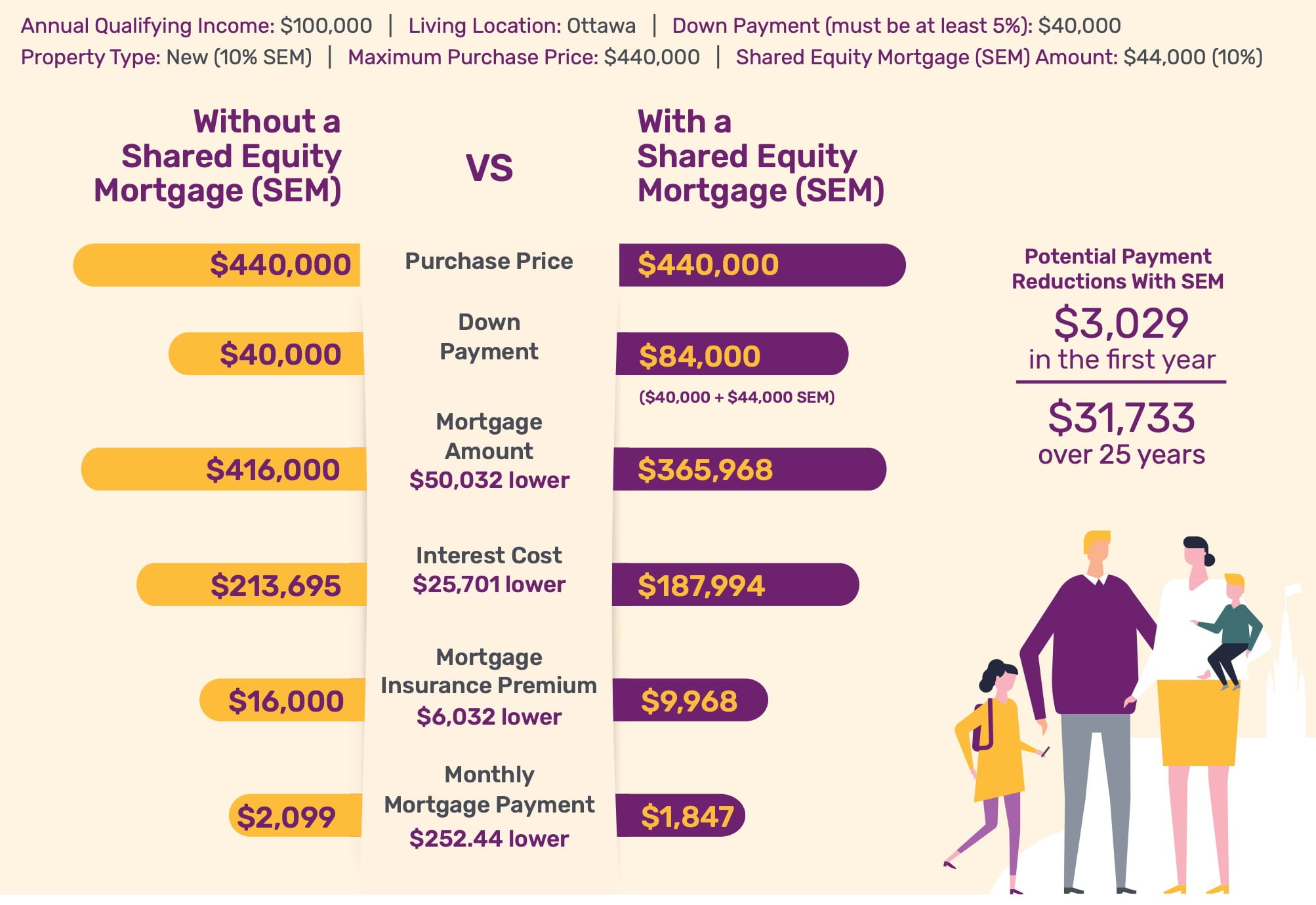

First Time Home Buyer Incentive (FTHBI)

This program is designed to help first-time homebuyers with their down payment. The government will provide up to 5% of the home’s purchase price for a resale home, or up to 10% for a newly constructed home, in the form of an interest-free loan. This loan is repayable over a 25-year period or when the home is sold, whichever comes first.

To qualify for this program, you must have a maximum household income of $120,000, have at least 5% of the home’s purchase price saved for a down payment, and have a mortgage that is less than four times your household income.

First Time Home Buyer Incentive Illustration

Home Buyers’ Plan (HBP)

This program allows first-time homebuyers to withdraw up to $35,000 from their RRSPs to use as a down payment on a home. The withdrawn amount must be repaid over a 15-year period, starting in the second year after the withdrawal.

To qualify for this program, you must be a first-time homebuyer or have not owned a home in the past four years, and you must have a written agreement to buy or build a qualifying home.

GST/HST New Housing Rebate

This program provides a rebate on a portion of the GST/HST paid on the purchase of a new or substantially renovated home. You can read all the details about the program on the Government of Canada website.

CMHC Green Home

This program provides a partial refund of the mortgage insurance premium to homebuyers who buy an energy-efficient home or make energy-saving renovations to an existing home. The CMHC Green Home program offers a partial premium refund of up to 25% directly to borrowers who either buy, build or renovate for energy efficiency using CMHC-insured financing. The program helps make energy-efficient housing choices more affordable. Natural Resources Canada (NRCan) is updating the EnerGuide rating system on a province-by-province basis. Effective June 20, 2022, CMHC’s Green Home program is now CMHC Eco Plus. The new name is also an enhancement to the program. Now, you can apply for a partial premium refund of 25% if you’re CMHC insured and have an energy-efficient home

Provincial Programs

Public Essential and Key (PEAK) Program

The Public Essential and Key (PEAK) Program in Alberta is designed to assist first-time home buyers in the province by providing them with down payment assistance. Through this program, eligible homebuyers can receive a grant of up to 5% of the purchase price of their home to cover their down payment and closing costs. The grant is in the form of a repayable loan and is interest-free for the first five years. After that, the loan must be repaid over the remaining term of the mortgage.

To qualify for the Alberta PEAK program, you must be a first-time home buyer with a household income below $80,000 (if you have no dependent children living at home) or $90,000 if you do have dependent children living at home. You must also have at least $1,000 available for your down payment and meet the minimum requirements for a mortgage, including a minimum credit score, proof of income, and a stable employment history.

To date, this program has helped 111 homeowners–and while the program currently isn’t offering any available homes, you can find more information on their website.

Attainable Homes Calgary (AHC) program

Conducted in partnership between the City of Calgary and The Calgary Foundation, this program provides down payment assistance in the form of a grant, for participants in Calgary who only have $2,000 for a down payment. The grant provided is interest-free and, as long as you’re the primary resident of the household, doesn’t need to be repaid.

However, In exchange for the grant, the AHC program takes a portion of your home’s appreciation: 100% of the home’s appreciation in the first year, to 25% after five years.

The best part is, you don’t have to stay for a minimum amount of years when buying your home through this program–however, if and when you decide to sell, you’ll need to pay for:

- The down payment loan

- A home appraisal

- Whatever portion of the home’s price appreciation belongs to the AHC

To be considered eligible for this first-time home buyer incentive, you need to have:

- A down payment of $2,000

- A household income of $103,000 for families, or a household income of $93,000 for couples without children, or a household income of $83,000 for individuals

- Assets worth $50,000 or less

- Completed the program’s home education session

The First Place Program in Edmonton

Through the City of Edmonton’s First Place Program, first-time home buyers are provided with a five-year deferral on land costs on townhomes that are being redeveloped on vacant school sites by certain builders. However, those who tap into this program have to pay back five years’ worth of land costs after five years have passed.

To qualify for this Alberta first-time home buyer incentive, you need to:

- Have a combined household income of $117,000

- Get pre-approved by a mortgage lender

- Have at least 5% of the down payment

- Be a first-time homebuyer in Alberta

- Live in the property, for the first five years as the primary resident

- Be a Canadian citizen or have permanent resident status

To learn more about these programs, visit the websites of the Canada Mortgage and Housing Corporation (CMHC) and the Canada Revenue Agency (CRA).

Becoming a homeowner in Alberta can be a proud achievement with the right preparation and a clear understanding of the process. Fortunately, there are several incentive programs available specifically designed for first-time home buyers in Alberta. Make sure to conduct thorough research to identify programs that can enhance your buying power as a first-time homeowner. Once you have budgeted and are ready with your down payment, My name is Bharat Verma and at Magic Mortgage we are available to guide you through the mortgage approval process and happy to assist you in your journey toward homeownership.

FAQ